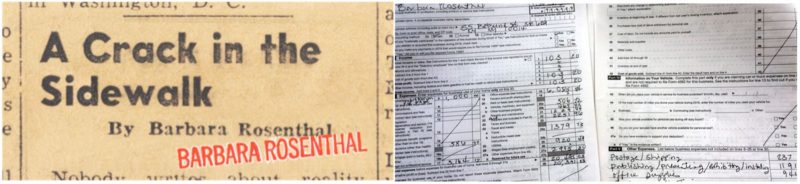

TAX TIPS FOR STARVING ARTISTS:

Relax and Have Fun Claiming Your Loss

by Barbara Rosenthal

Contributing Columnist

May 1, 2019, NYC —

In the three audits I’ve had since I began filing my own taxes in 1977, I came out even in two and ahead in one. In all three, the auditor found my way of doing things, and use of Schedule C (Business Profit and Loss), outside the parameters of the usual businesses they dealt with, so called in supervisors, who, by the third time, had given me enough tips to teach me how best to state my losses as an artist — which, like most of you, can offset the gains you make to put food on the table, i.e. teaching, cab driving, etc. The three auditors and three supervisors, who at first began looking for  undeclared income or bogus expenses, gradually became intrigued with the economics of art-production for the vast majority of artists, and little by little taught me how to make out best, and how to avoid my returns being flagged.

undeclared income or bogus expenses, gradually became intrigued with the economics of art-production for the vast majority of artists, and little by little taught me how to make out best, and how to avoid my returns being flagged.

The public disclosure of tax returns is much in the news these days, taxes returns were just due on the same date as this draft, and, since this column often mentions the difference between taboos in the general population that artists commend each other for breaking (such as pussy paintings), vs taboos in the artworld broken only under threat of vilification (such as personal finances), this seems like a good time to make some hard-won suggestions about you and the IRS. These tips about Schedule C, and how I’ve dealt with spending during the year leading up to filing, are what’s in this month’s column.

YOU’RE A PROFESSIONAL, NOT A HOBBYIST:

Declaring a loss for several years in a row makes the normal-type people of the IRS think we might just have a hobby (which isn’t deductible), so to avoid that insult, attach documentation from that tax-year to the return (i.e., a postcard of show, reading, performance, review, etc.). There is no limit on the number of years you can claim a loss while there is evidence that you’re trying to make it big. (I’ve actually known artists to fake a greater sales-income, which isn’t necessary at all!)

As for profession, I fill in “Conceptual Artist” and choose “999999” as the profession code.

SPENDING DURING THE YEAR:

Use checks and credit cards, not cash, so that each expenditure will be listed on your monthly statements without your needing to keep paper receipts. It is simplest to keep artmaking-related purchases separate from personal ones, but if you can’t (such as my purchases from Amazon, which aren’t itemized on their Chase Amazon 5% cash back credit cards statements), you’ll need to either separate the info when you file, or declare only a percentage of that particular expense or card.

In my case, I figure 50% of what I spend on Amazon with the Chase Amazon card, is art-related. But for everything I don’t buy on Amazon, I use my Citibank 2% cash back card, which itemizes the rest of my payees. (SIDE NOTE: For 3% back in restaurants, I use my Chase AARP card.)

TRACKING and LISTING EXPENSES:

If you do everything online, fine. I still prefer paper statements, which I keep in a binder. But either way, come April, divide a piece of blank paper into many narrow columns for expense categories, and look at the statements one by one. When you come to the first company you paid for art-related expense (i.e. “Garber’s Hardware, $25.99”), decide what category you’d like to call it (i.e. “Studio Maintenance”). Head the first column “Studio Maintenance” and put “25.99” in that column. Then just keep going.

Use as many column-categories as possible! List some separately on Schedule C in the “Other” box. This was one of the most important tips my last auditor gave me. The IRS probably won’t question totals of several hundred dollars in several different categories (i.e. “Photo Processing $236,” “Web Services, $357” “Video Documentation $488,” or “Art Materials $710,” “Art Equipment $877,” “Photo Supplies $406,”), but they might well question “Services $1081” or “Supplies $1993.” You can also keep “Office Supplies,” (which you would come across on your credit card statements as “OfficeMax,” for example) separate from other types, too. Then just add up the columns and fill in the blanks on Schedule C.

My own columns for 2018 were: Advertising (my ArtForum ad), Insurance, Professional Services (which was my studio assistant), Office-Studio Expense (which was studio rent), Vehicles (which were taxis and other wheels), Other Business Property (which was art-storage unit), Travel, Meals & Entertainment (which was all those times I took you out for coffee, etc), Maintenance (which was what I paid for hardware, lumber, a handyman and a cleaning-person), Utilities (see “Studio” below) and Other (which separately listed Art Supplies, Digital-Video Supplies, Photo Supplies, Computer Supplies/Equipment, Office Supplies, Postage & Shipping, Books & Publications, Internet Services (such as webhosting), Media Services (such as video documentation).

(SIDE NOTE: I actually have come to LOVE doing the listing! Firstly, it shows me just how I have apportioned the great deal of money I’ve spent on my work. It truly wipes out most everything I make from other gigs during the year. When one auditor asked about what was left to live on (which just about equalled the “Standard Deduction,” I told him, “Some people even live on less,” which is, unfortunately, quite true. And secondly, it is a simple fill-in-the-blanks kind of game with relatively known outcome, very unlike the art and writing and video and performance I do, which demands stressful, incessant decision-making about infinite variables.)

TRAVEL:

If you travel for exhibition, readings, etc, but also to include photos or videos in your work, or even to gather material for it, you can have a “Travel” column, and list everything related to that travel. You don’t need to separate food or fares, etc. (SIDE NOTE 1: One thing I have found to be the single thing most unfair to ordinary workers by the way, is that businesspeople who might fly first class for work can deduct their fares and lunches, but workers who take the subway and eat at a hot dog stand can’t. The IRS frames executive expenses as “what it cost to do business,” but I think it would be much more fair to frame them as “what it cost to earn a living.” I say this as often as possible. Who knows: if enough of us do, maybe we can influence the tax laws!) (SIDE NOTE 2: Different credit and debit cards have different transaction fees for expenses in foreign currency, too, so check with your banks so you don’t spend more than you have to, and different countries and villages, as well as individual payees have different customs re cards and cash-of-the-country, but in general it is better for many reasons to use a card. To get foreign cash from an ATM abroad, debit is often better than credit, but check with your banks.)

STUDIO/OFFICE & UTILITIES

and CLOTHING, etc:

If you have a studio and or office separate from your home, 100% of those monthly payments are deductible. If you have a room or rooms or alcove in your home that you use as a studio and./or office, the percentage of that floor space, and the same percentage of related utilities, maintenance, etc, is deductible. If you share a place with others, now that you know the basic idea, you can figure out how to handle the percentages of what’s yours and how much of it is for your professional use.

I mention “Clothing, etc.” here because if you purchased anything for professional use, it is deductible for that percentage of use. I would never even have thought about clothing, until an incident I once witnessed at another auditor’s desk when I walked past: a woman nearly in tears was trying to explain why she claimed a pair of shoes; she was trying to tell her auditor that she had bought them for some professional purpose. But the auditor then got her to say she did indeed wear them after that. She took on the defeated aspect of a master-criminal about to be executed, but the auditor was kind, and explained the rule of percentage. (Of course, she could have just said she wore them only that once, but …)

THE NUMBERS 5 AND 9:

This relates to percentages and estimates. One of the supervisors told me that if there are many number 5s showing up as final digits, your return might be flagged on suspicion of estimating. If a disproportionate number of 9s show up, it might be flagged on suspicion of under- or over-reporting.

AUDITS:

If you did your own taxes, and you didn’t cheat, and you know what you did, there is no reason to fear an audit because you can easily answer the questions and show-and-tell. I was scared to death my first one, but discovered at that time and with all six auditors and supervisors who met me in their huge floor-space open-plan buildings, they face a lot of stress dealing with cheats, dissemblers and people who don’t understand their own tax returns, and with bullies who try to intimidate them. After a while I felt that they themselves assumed a helpful attitude, and were glad for the relief; all of them also had a family member or knew someone with aspirations in the arts. Eye contact is important, and establishes a relaxed bonding. They began to enjoy the separation of my expenses into smaller categories, and to be creative in thinking about how to make the system work in an artist’s favor. They felt good about showing off their knowledge and being teachers, even mentors, rather than cruel enforcers, is what I felt, grateful for the advice they gave me.

That huge room was a fantastic theater to be aware of, even while sitting across the desk while my auditors were going through my bank and card statements, looking for unreported income (ha!) and matching the figures in my columns to the figures on the statements. I don’t especially want to be subjected to any more of them, but for an “improv,” i.e. a think-on-the-fly experience with one or two strangers that has a theme but can take various, unexpected turns, the experience of being audited is very, very interesting.

OK, it’s May now, so this year’s tax forms have been sent in, but you can start using credit and debit cards and checks, and perhaps keeping ideas for your own categories in mind as you receive your monthly bank statements, to be ready next time. My whole procedure took about 4 hours, I had $20,391.83 in Schedule C business loss, and paid no tax this year. Happy Spring!

Barbara Rosenthal is an idiosyncratic New York artist/writer/performer/philosopher whose latest book, the novel, Wish for Amnesia (Deadly Chaps Press, 2018) explores themes of idealism, innocence, esthetics, dimensionality, thought and corruption. She is particularly interested in the intersection of art and life.

About the novel: wishforamnesia.com

Calendar of events: http://www.emedialoft.org/artistspages/frameEleven.htm

TWITTER: @BRartistNYC

WIKIPEDIA: https://en.wikipedia.org/wiki/Barbara_Rosenthal

WEBSITE: http://www.barbararosenthal.org

To comment on this column, please message FACEBOOK: https://www.facebook.barbara.rosenthal1.com

Bi-MONTHLY COLUMNS: Barbara Rosenthal, A Crack in the Sidewalk:

May-June 2019: Tax Tips for Starving Artists: Relax and Have Fun Claiming Your Loss

Mar-Apr 2019: Flying High, Lying Low: The Ups and Downs of an International Art Career

Jan-Feb 2019: Studio Assistants: Expect the Unexpected and What Else to Expect

Nov-Dec 2018: Media Art Restoration: The Craft of the Art of the New Old New

Sep-Oct 2018: Impositions or Independence: A Call to Reject Corruptions to the Artist

Jul-Aug 2018: Process vs Product: What is the Point of Art / What is The Interplay of Elements and Considerations in Artmaking

May-Jun 2018: Roles, Ideals and Job Descriptions: The Artist; The Viewer; The Naif; The Collector; The Curator; The Critic; The Art Dealer

Mar-Apr 2018: The Production of Meaning in Art Fabrication: What Are You Doing? Do You Know? When? Before or After?

Jan-Feb 2018: Is There a Universal Esthetic? Naifs, Innocence, Education, Esthetics

Nov-Dec 2017: Journaling

Sep-Oct 2017: By this first sentence here now, back upon the Earth

Recent Comments